While some brands continue to attract consumers back to their dealerships, the post-pandemic rebuilding of vehicle stocks means that fewer new-vehicle buyers are loyal to the brand they currently drive.

“As vehicle availability increased and more choices hit the market for consumers, loyalty among brands as a whole saw a decline this year,” said Tyson Jominy, vice president of data & analytics at J.D. Power. “Additionally, owners were tied down to their vehicles for longer than normal due to ongoing supply chain disruptions, and as a result were more likely to experience problems with their vehicles.”

But there are things brands can do to encourage customer loyalty, Jominy argues. When they experience excellent build quality or a good ownership experience, shoppers tend to reward brands by returning to them.

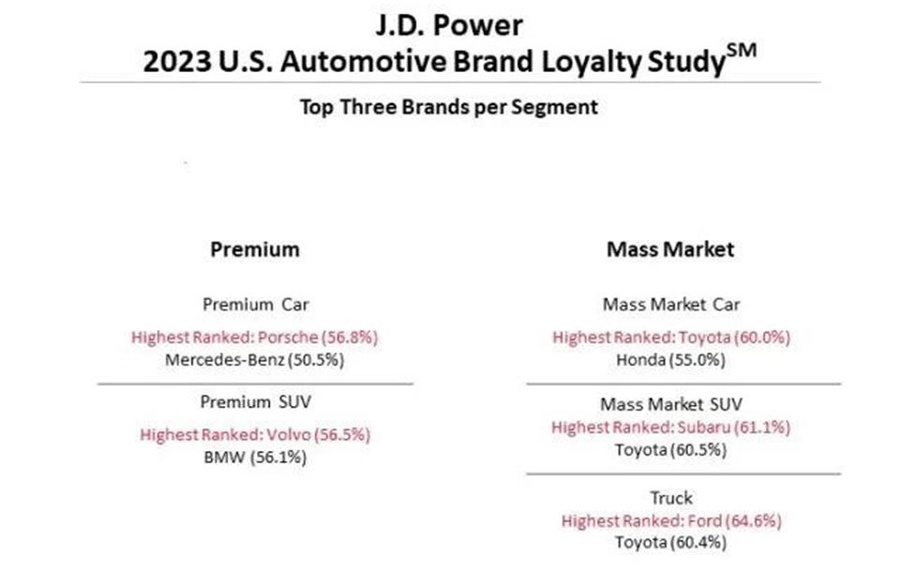

Highest-Ranking Brands

- Porsche ranks highest among premium brand car owners for a second consecutive year, with a 56.8% loyalty rate. Mercedes-Benz (50.5%) ranks second.

- Volvo ranks highest among premium brand SUV owners with a 56.5% loyalty rate. BMW (56.1%) ranks second.

- Toyota ranks highest among mass market brand car owners for a second consecutive year, with a 60.0% loyalty rate. Honda (55.0%) ranks second.

- Subaru ranks highest among mass market brand SUV owners with a 61.1% loyalty rate. Toyota (60.5%) ranks second.

- Ford ranks highest among truck owners for a second consecutive year, with a 64.6% loyalty rate, the highest loyalty rate in the study. Toyota (60.4%) ranks second.

The study, now in its fifth year, uses data from the Power Information Network to calculate whether an owner purchased the same brand after trading in an existing vehicle on a new vehicle. Customer loyalty is based on the percentage of vehicle owners who choose the same brand when trading in or purchasing their next vehicle. Only sales at new-vehicle franchised dealers qualify. The study includes brand loyalty across five segments: premium car; premium SUV; mass market car; mass market SUV; and truck.

The 2023 study calculations are based on transaction data from September 2022 through August 2023 and include all model years traded in.

Source: J.D. Power